Successful investors look for stable stocks in fluctuating markets. Stock market is always a risky investment. But as value investors say, "Investing isn’t risky; not being in control is." Risk comes from not knowing what you’re doing. A successful investor manages risk aptly such that their investments bear handsome returns in the long run while preserving the investment capital. Investing in blue chip stocks helps reduce risk.

Blue chip companies in India are measured as most stable stocks for investment. The Indian stock market has thousands of listed companies but most of them are either average performers or wealth destroyers. A Blue chip stock is a stock of well- established company which has reputation to operate profitably in adverse economic conditions. Blue chip companies are market as well as industry leaders. These stocks command huge investor confidence as they are known for stability and reliable returns. The name blue chip is derived from poker casino tokens where blue chips are of high value.

Blue chip stock companies also declare dividend on regular intervals. Getting dividends during the havoc of bear markets shows that the company one has invested in is positive about its cash flows. A Blue chip company performs well when compared to its competitors during difficult times. Some examples of Indian blue chip stocks are Reliance Industries Ltd., State Bank of India, TCS, ONGC, Infosys, HDFC, Bharti Airtel etc.

Blue chips are generally safe to invest. But that doesn’t mean the investors should buy these stocks blindly. There have been cases like Satyam Computers where the wealth creators turned into wealth destroyers. Proper financial analysis and expert opinion is advised as blue chip stocks are costly due to high valuation. It is of utmost importance to buy right stock at a right intrinsic value.

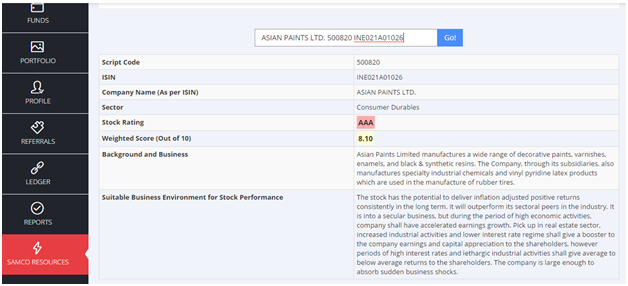

SAMCO, one of India’s leading online discount broking firm has created a stock rating tool which rates listed securities on NSE platform. A tool that rates stocks and businesses on key business parameters, matrices and grades every stock rating from “AAA” to “Penny Stock”. Naturally, robust businesses with strong fundamentals are rated better and the rating falls as the quality of the business dynamics deteriorates. The ratings add to investor knowledge and alerts investors against making wrong investment decisions. Investors can decide whether to buy or not to buy after assessing the stock rating on SAMCO platform. The rating acts as a guide or a 'second opinion' as one may say!

|

| Samco Stock Rating |

SAMCO’s stock rating platform accesses 20 vital business parameters. Factors like industry and business model, sustainability, cash flow, EBITDA results, managerial decisions, corporate governance etc. are taken into consideration before publishing a stock's rating. SAMCO’s stock rating process and rating scale is similar to many credit rating business models. AAA being the highest and Penny being the lowest. A weighed score is published on the scale of 1 to 10. It should be noted that stock rating process doesn’t evaluate stock price because of price fluctuation.

In case of blue chip companies, stock rating of most companies would fall in the rating scale of AA to AAA with a weighed score above 8 out of 10. Stock rating for blue chip companies would help investors in understanding the fundamental analysis of a company and the industry in which it operates.

theindiancapitalist.com advises its readers to keep a long-term horizon for blue chip stocks to yield better returns. Keep investing!

Disclaimer – Information provided is purely based on our research. Please consult your financial advisor before making any investment decisions.

investing in this stock is as risky as gambling, but I need a bigger amount of money so I invest less in the stock, instead I gamble on 918kiss Malaysia, spend less money make less money But I feel safe

ReplyDelete